Jordan Tarver has put in 7 a long time masking mortgage loan, particular mortgage and business enterprise bank loan content for foremost financial publications including Forbes Advisor. He blends awareness from his bachelor's degree in enterprise finance, his experience like a prime perf...

Payday alternative loans. Some federal credit history unions offer payday option loans (Buddies) as much as $one,000 with APRs capped at 28%. You need to be considered a credit score union member for at least per month to qualify, on the other hand — so you may not Get the money at once.

Nevertheless, this may be tough rather than a great notion. For those who apply for a mortgage, a lender will decide your application based upon your power to repay right now, not five months from now. And when you’re not earning any income presently, Then you definitely aren’t very likely to be authorized for your mortgage.

However, taking on several loans will increase your economic chance and will make repayment hard. Lenders will likely take into account your personal debt-to-earnings ratio, that can include things like all of your current loans and disability payments.

Are there any constraints on how I can utilize the personal loan dollars? Typically, own loans offer you essentially the most flexibility on ways to utilize the money, whether it’s for clinical expenditures, home repairs, or other own requirements.

According to the Facilities for Illness Command and Prevention (CDC), one in 4 American adults has some kind of disability. A good portion of this population – a person in four men and women in between the age of eighteen and forty four – has an unmet wellness treatment require because of Value.

Veterans’ Gains. Loans typically never affect veterans’ disability Positive aspects Unless of course explicitly stated from the benefit’s disorders.

Get your money. If approved for your personal bank loan, the lender disburses your funds on your bank account or sends you a Look at — typically involving one particular to 5 small business days.

If at all check here possible, collaborate with lenders who report payments towards the credit history bureaus. Sensible Financial loan, for instance, reviews payments to 2 of your a few big credit rating bureaus, rendering it convenient to ascertain credit rating with amongst our loans.

Disability loans might be helpful if you have a direct require for unexpected emergency funding to create ends meet up with. Nevertheless, they need to be A final vacation resort if you have the ability to protected other types of lower-Price tag financing that gained’t place a pressure on the month-to-month funds.

Individuals that receive disability payments can entry own loans, shorter-time period installment loans, money applications and other sorts of short-time period funding. Below are a few of the greatest financial loan selections if you receive disability payments:

Immediately after finishing the net software, the SSA establishes who qualifies for disability Added benefits through the use of a process that takes 5 months to finish and involves the five pursuing inquiries:

Forbes Advisor adheres to rigid editorial integrity benchmarks. To the most beneficial of our understanding, all articles is exact as of the day posted, though provides contained herein could no more be offered.

Also, dependant upon your point out’s regulations, you might be qualified for additional disability Positive aspects In case your injuries has considered you struggling to function.

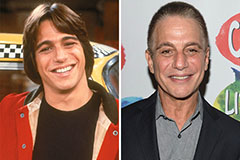

Tony Danza Then & Now!

Tony Danza Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!